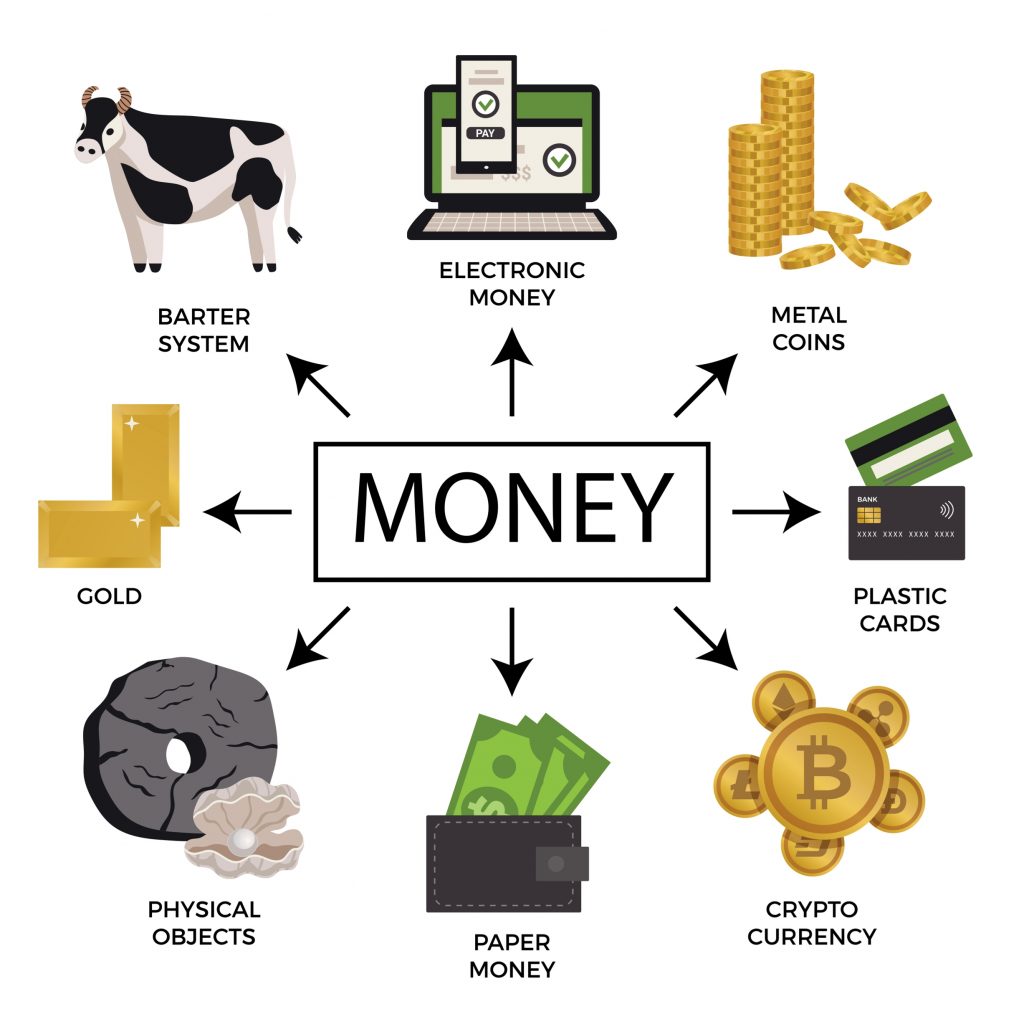

According to history, the first kind of money people used was commodity money, which is a currency whose value comes from the commodity from which it is made.

There was an exchange of goods according to the value of different items. Various articles of different value were bartered to obtain other commodities.

The first gold, silver and bronze coins used as money, were minted in the region known today as the country of Turkey, which was then known as the Kingdom of Lydia – around 2,700 years ago. The value of coins at that time reflected the value of the material used. The first other metal coins began to circulate in the seventh century BC. History shows that people return to the use of commodity money during times of disaster. In some countries not so long ago, immediately. after the end of World War II, for example, cigarettes were used as a means of payment for goods distributed on the black market.

Paper Money

Paper money was first invented in China about one thousand years ago and consists of banknotes with the value printed on it. It is money made up of banknotes with the value printed on each banknote . Paper money started to circulate in Europe about mid-16th century. The trend grew to popularity by the mid-17th century. At that time, banks that produced banknotes, had to keep gold reserves of equal value in their treasury to guarantee the value of the notes. Today, issued banknotes are not always covered by an equal value of gold deposits. The printing and issuing of money can only be done by authorised banks.

Fiat Money

Today, the money in our bank account is also known as “fiat” money. The Arab Merchants in the Middle Ages, who used the bill of exchange as a method of settling accounts in international trade are attributed with introducing the concept of fiat money, also known as a bill of exchange, to Europe.

Instead of using physical money like banknotes and coins, they recorded loans and claims in their books. Currently, we most often use electronic payments, also known as digital money, for everyday living, such as when paying with a bank card in shops or authorising a transfer to pay for an electricity bill. When we withdraw cash at the cash machines, the electronic money (which is both digital money and fiat money) is converted into paper money( which is also fiat money).

Digital Money

Digital currency is a form of currency that is available only in digital or electronic form, and not in physical form. It is also called digital money, electronic money, electronic currency, digital cash or cyber-cash.

To use any form of digital money, we need to use technologies such as computers, laptops, tablets, smartphones, money credit cards, and online cryptocurrency exchanges for cryptocurrencies. We also need to use a lot of electricity.

Digital Cash

Digital cash term refers to money that may be transferred electronically from one party to another during a transaction.

Currently there is a tendency to replace physical cash with digital cash. One argument that speaks in favour of digital cash discusses its anonymity, however, such cash will not necessarily be anonymous if it is regulated by a central bank.

Incorporating digital cash in everyday life would require all of us to use technologies like smartphones for our daily purchases and become familiar with operating them successfully. Many people need glasses for reading, but not for other activities. Putting glasses on and off in a shop or even when shopping online, to have to read digital cash related text on smartphones, might become an additional inconvenience for many people with poor eyesight and that would need to be faced when switching to the digital cash system. With the arrival and exclusive use of digital cash for daily purchases cash machines would become obsolete .

Here in the UK, we could, easily generate electricity by installing domestic vertical wind turbines on our roofs or at the bottom of our gardens, as long as we ensure that they work properly. We could then sell the generated electricity to the grid, which could help to ensure that we have enough electricity for our digital cash. The generation of more electricity would also increase the quantity of digital cash in our bank accounts. However, to benefit from domestic wind turbines or solar power in order to generate more money or electricity , we do not need to wait for the digital cash system to be put in place.

Physical cash

Some electrosensitive people, for instance, are very disturbed by the use of the modern technologies of today and tomorrow that require the use of electricity. We also know that we need to shield children from being exposed to the excessive radiation that come with modern technologies.

Changing over entirely to digital cash would thus not be practical and wise. We must not forget that we live in times of environmental disasters like, floods, storms, tornedoes, fires, earthquakes and pandemics, therefore we are in danger of unexpected electric power cuts, disturbed media of communication and the possible physical indispositions of the masses all at once.

Physical money not only secures the means of exchange at the time of disaster, but also comes with many benefits during the times of stability. The coin or note is the best way to ensure our freedom of movement, the freedom that results from anonymity, the freedom to be spontaneous, the freedom from the land and even the freedom to exist away from our smartphones, that most likely will always need to be registered in our names.

The “best of both worlds” in this case, comes with a choice and involves maintaining access to physical money as well as digital money whenever we need it. Having availability of physical money will simply be a sensible thing to do: like our reason for keeping a spare wheel in our car.

Source of information:

A short history of money | Erste Financial Life Park| Erste Financial Life

Park | Financial Educationhttps://www.investopedia.com/terms/d/digital-currency.a

positivemoney.com